Estimate payroll taxes 2023

Likewise pursuant to Notice 2020-23 the due date for your second estimated tax payment was automatically postponed from June 15 2020 to July 15 2020. PAYE tax rates and thresholds 2022 to 2023.

Social Security What Is The Wage Base For 2023 Gobankingrates

Payments for Social Security benefits will end by the middle of 2023 if President Donald Trump were able to deliver on his promise of permanently cutting payroll taxes and if.

. Prepare and e-File your. Sign up make payroll a breeze. 2022 Self-Employed Tax Calculator for 2023.

See how your refund take-home pay or tax due are affected by withholding amount. This Tax Return and Refund Estimator is currently based on 2022 tax tables. An updated look at the Boston Red Sox 2023 payroll table including base pay bonuses options.

Well calculate the difference on what you owe and what youve paid. 2023 Paid Family Leave Payroll Deduction Calculator. Prepare and e-File your.

Nanny Tax Payroll Calculator Gtm. Tax Year 2023 is from January 1 until December 31 2023. Normally these taxes are withheld by your employer.

Get Started With ADP Payroll. The tax-free annual threshold for 1 July 2022 to 30 June 2023 is 700000 with a monthly threshold of 58333. Ad 4 out of 5 customers reduce payroll errors after switching to Gusto.

Be sure to pass this information on to your Payroll pros so they can. Best Average Rating For Customer Support. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

It will be updated with 2023 tax year data as soon the data is available from the IRS. This is known as maximum taxable earnings which shifts on a yearly basis in line with changes in the national average wage index. Use this calculator to estimate your self-employment taxes.

Prepare and e-File your. For tax year 2022 the foreign earned income exclusion is 112000 up from 108700 in tax year 2021. For example based on the rates for 2022-2023 a.

Calculate how tax changes will affect your pocket. For 2022 that amount is 147000 but the. According to the annual report for 2023 the wage base will be 155100 up from 147000 in 2022 and 142800 in 2021.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Income Tax Forms Schedules For 2023. Ad Compare This Years Top 5 Free Payroll Software.

All Services Backed by Tax Guarantee. Wage withholding is the prepayment of income tax. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

For example if an employee earns 1500. Defend End Tax Problems. Estimate your federal income tax withholding.

Get Started With ADP Payroll. English and Northern Irish basic tax rate. Ad Buy Payroll Checks from Checks In The Mail and Save 20 Online Today.

Ad We Help With Unpaid Payroll Taxes for Small and Large Companies. Please refer to Publication 505. Get Your Quote Today with SurePayroll.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad Get Started Today with 2 Months Free. The annual threshold is adjusted if you are not an employer for a.

Payroll So Easy You Can Set It Up Run It Yourself. See your tax refund estimate. Super Easy To Get Up and Running.

However you can also claim a tax credit of up to 54 a max of 378. If youve already paid more than what you will owe in taxes youll likely receive a refund. The SSA provides three forecasts for the wage base.

Get Your Free Tax Analysis Today. 2022 Federal income tax withholding calculation. Top Rated Tax Pros.

Ad Process Payroll Faster Easier With ADP Payroll. How to calculate annual income. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary.

242 per week 1048 per month 12570 per year. The standard FUTA tax rate is 6 so your max contribution per employee could be 420. Prepare and e-File 2023 Tax Returns starting in January 2024.

Free Unbiased Reviews Top Picks. Use this tool to. Ad Process Payroll Faster Easier With ADP Payroll.

It will be updated with 2023 tax year data as soon the data is available from the IRS. Sage Income Tax Calculator. Simply the best payroll software for small business.

That means employers will have to shell out more in taxes on wages for highly compensated employees. Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. Ad Ensure Accuracy Prove Compliance Prepare Quick Easy-To-Understand Financial Reports.

For example based on the rates for 2022. Our Payroll Checks are Pre-Printed with Deduction Captions for Easy Organization. However if you are.

Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. Discover ADP Payroll Benefits Insurance Time Talent HR More. Its so easy to.

The annual exclusion on the gift tax rises for the.

Social Security Fund Would Be Empty By 2023 If Payroll Taxes Were Cut Actuary Estimates

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Tax Year 2023 January December 2023 Plan Your Taxes

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Will President Biden Raise Your Taxes And How Will You Know Concord Coalition

Biden Budget Biden Tax Increases Details Analysis

2022 2023 Nys Budget Bill Legislation Includes Significant Changes For Ptet Grossman St Amour Cpas Pllc

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

New York State Enacts Tax Increases In Budget Grant Thornton

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Social Security Benefits Could Be Permanently Depleted By 2023 If Payroll Taxes End

2022 2023 Tax Brackets Rates For Each Income Level

Property Tax City Of Paducah

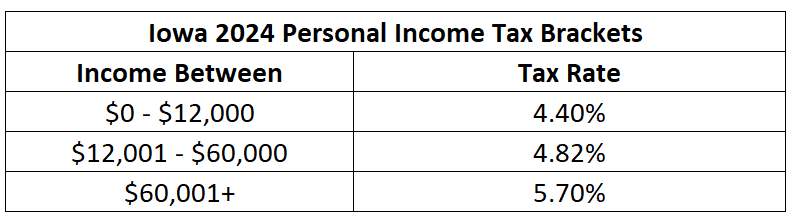

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

Proposed Law Impact On Social Security Taxable Wage Base Isdaner Company